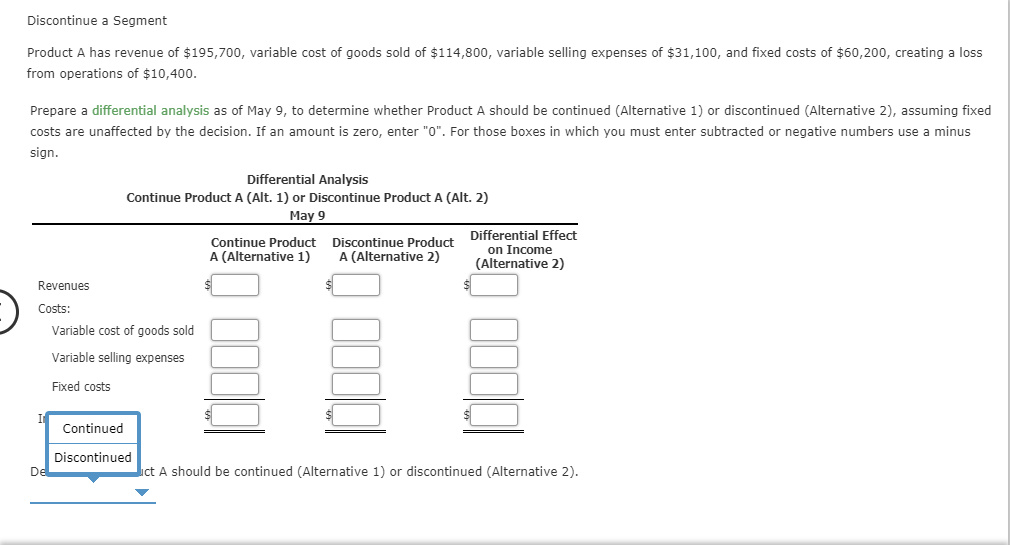

Content

This may present the false notion that there is more money in the account available to be spent than there should be. If the payor spends some or all of the money that should have been held in reserve to cover the check and then said check is later cleared, the account ends up in the red. When this happens, the payor will be charged an overdraft or non-sufficient funds fee by the bank, unless the account has overdraft protection. An outstanding check is a check that a company has issued and recorded in its general ledger accounts, but the check has not yet cleared the bank account on which it is drawn. This means that the bank balance will be greater than the company’s true amount of cash. An outstanding check remains a liability of the payer until such time as the payee presents the check for payment, which then eliminates the liability. Abandoned Property Law §1422 requires New York State to perform certain payee notification requirements for uncashed checks.

Professional accountants and bookkeepers deal with Outstanding Checks during reconciliation, a time where they are balancing their ledgers as they approach closing the books for the month. It’s getting easier to process payments, so it probably doesn’t come up as much for B2C businesses as it did when more consumers wrote checks. Most accountants prefer to cut a check because it leaves a paper trail that is easy to track, so unclaimed checks will probably continue to persist for businesses paying other businesses. Create a list of outstanding checks or get a list from the bank.

Risks and Outstanding Checks

Due diligence procedures performed at this time include sending a written reminder to the payee giving him the option of either cashing the check or requesting a replacement check if it has been lost or stolen. If no response is received from the payee and the check is over one year old, again every effort is made to contact the payee and inform him of his claim to the monies. If we again do not receive a response, the unclaimed monies are forwarded to the Virginia Department of the Treasury, Unclaimed Property Division. At this point, if the payee chooses to claim the funds, he must contact the Commonwealth.

Amounts over $100 that meet the time requirement of release are transferred to the State of Texas Comptroller’s Office by July 1st of each year, while the remaining population is retained on the City’s books. Some businesses print “Void after 90 days” on their checks to encourage recipients to deposit checks more promptly. Most banks will continue to honor checks for the full 180 days, but that isn’t guaranteed. To prevent https://online-accounting.net/ problems, you should cash or deposit a check promptly after receiving it. If a payee receives a check and does not present it for payment at once, there is a risk that the payer will close the bank account on which the check was drawn. If so, the payee will need to receive a replacement payment from the payer. An outstanding check is a financial instrument that has not yet been deposited or cashed by the recipient.

Emergency Services & Information

Outstanding checks and unclaimed property held by the City can be found below. To view property held by the State of Texas, visit the Office of the Texas Comptroller website. Call or email payees who fail to deposit checks and ensure that the check was, in fact, received. If they have the check, try to persuade them to deposit the check. If that doesn’t work, send a letter informing payees the check has not been presented and officially request they notify you if they have not received the payment. This process is part of the accounting cycle, allowing the company to accurately report cash, a current asset, on its balance sheet.

Do outstanding checks add or subtract?

Outstanding checks.

Since outstanding checks have already been recorded in the company's books as cash disbursements, they must be subtracted from the bank statement balance.

Investing in alternative assets involves higher risks than traditional investments and is suitable only for sophisticated investors. Alternative investments are often sold by prospectus that discloses all risks, fees, and expenses. They are not tax efficient and an investor should consult with his/her tax advisor prior to investing. The value of the investment may fall as well as rise and investors may get back less than they invested. Fortunately, banks don’t have a legal obligation to honor checks written more than six months in the past. A check is a written, dated, and signed instrument that contains an unconditional order directing a bank to pay a definite sum of money to a payee. Contact the recipient of the check and ask if they lost the check or when they plan on cashing it.

What do I do if I have an old outstanding check that never got cashed? Can I write it off?

As mentioned above, you may need to return the original check or sign documents confirming the check is lost or destroyed. If you cannot find the issuer, consult your state’sabandoned property program to claim assets. When you pay someone by check,your payeemust deposit or cash the check to collect the payment. The payee’s bank will request money from your bank, and the transaction concludes when your bank sends funds to the payee’s bank.

State Comptroller DiNapoli and Brooklyn DA Gonzalez Announce … – Office of the State Comptroller

State Comptroller DiNapoli and Brooklyn DA Gonzalez Announce ….

Posted: Thu, 05 Jan 2023 08:00:00 GMT [source]

It’s a way of making sure that you and your bank agree about your account balance and available funds. It can be tricky to balance a checkbookand we have a worksheet with step-by-step instructions to help you.